Investing in shares can be a great way to increase your wealth over time and it is important to keep up with how they are performing. If you have a well-planned and diversified portfolio you can start to generate wealth.

Here are 5 key points to keep in mind as you go about managing your share portfolio.

1. Keep a long-term view

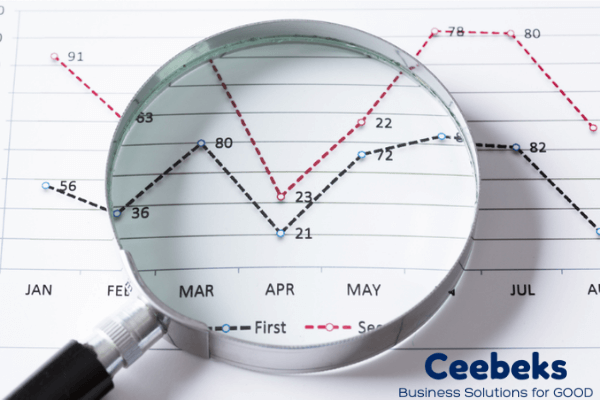

It is easy to fall into the habit of checking your shares all day, every day. The downside to this is that you can begin to start making emotion-based trades which are not necessarily in your best interests. Shares are a long-term asset. No matter how hard you try there is no magic formula for timing share trades. If you try to outsmart the market you may find yourself drowning in transaction fees. The value of your shares will go up and down from month to month, and the dividend may vary.

2. Keep calm and carry on!

When share prices go down, often dramatically, the despair and panic can set in. Rises and falls are inevitable and if you have a long-term game plan any short-term fallings are not as bad as you may think. If you feel one of your shares has hit the highest point and is about to fall you don’t have to sell the lot. Another tactic is to take out your original investment and leave the gains there. If in doubt seek the advice of a qualified financial advisor.

3. Capital losses

A capital loss can occur when you sell your shares and not before. A capital loss is when the proceeds from the sale of an asset are less than what you paid for it.

4. Don’t use a strategy driven by tax considerations

Don’t hang on to profitable shares just to avoid paying capital gains tax. You can use your capital gains and capital losses as tax time. Seek advice here, don’t try to develop some sort of tricky gain and loss plan.

5. Don’t put all your eggs in one basket!

A diversified portfolio is one way to help minimise your overall risk and grow your wealth. For example, if you have some property in your portfolio along with shares you may find when one is up the other may be down.

If you want to discuss your investments and financial goals give us a call or drop us a line today. Here at CeebeksTM Business Solutions for GOOD we are a one-stop shop for all of your business needs and we have great ‘barista-style’ coffees or gourmet tea.

General advice disclaimer

The advice provided is general advice only as, in preparing it we did not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of this advice, you should consider how appropriate the advice is to your particular investment needs, and objectives. You should also consider the relevant Product Disclosure Statement before making any decision relating to a financial product.

Only financial planning advice provided by CeebeksTM Financial Solutions is associated with Avana Financial Solutions.

Christopher Beks (Authorised Representative no. 231937) is a director of CeebeksTM Financial Solutions (Authorised Representative no. 344518) and an Authorised Representative of Avana Financial Solutions Pty Ltd AFSL 516325 and is authorised to provide personal financial advice.